Written by Promise Phelon, GWC's founder and managing director

——

Never underestimate Larry Ellison or Julie Sweet, the rising heroes of enterprise automation and AI

As well-informed, forward-thinking investors in private and public markets, you likely did a double-take when Oracle announced its earnings in Q3 2025. Pow! Thanks to several large multi-year, multi-billion-dollar contracts, its stock jumped to a record high of $345.69 per share. That’s a monstrous 36.7% increase and Oracle’s largest one-day percentage gain since 1992. It’s a big win, as few have considered the company a major player in the AI race.

I've been watching this evolution, and I never doubted Oracle would find the ideal channel for a win. Don’t underestimate Larry Ellison! What’s all this mean for you and the GWC team? We've talked about the shifting nature of the customer and the role of data as a sustainable MOAT in AI. Well, on both those fronts, Oracle has a built-in advantage. You already get why data matters, so let's talk about the other mega differentiator: enterprise customer relationships.

Over the last 30 years, SaaS has brought about massive transformation and, along with it, a tsunami of products and subscriptions. Yet customers still have to fight for any real productivity improvements, which is why enterprise buyers have become smarter about how they work with technology providers; they’ve become more mercenary, wanting fewer layers in the technology stack, less complexity for their teams, more performance and IRR for every dollar spent and enduring, trusted partnerships.

At the same time, technology and AI have been on an exponential tear in terms of capability, functionality and risk. The stakes for buyers are higher than ever because the average enterprise stores more than 23 billion files, amounting to 10 petabytes of data. It’s that big because enterprises generate vast amounts of data through operational systems like ERP platforms, CRM tools and supply chain software. Each transaction, whether financial, logistical or customer-related, adds to the expanding datasphere.

Think of it: Just one miscalculation around an AI investment could expose customer records, break SLAs at unprecedented scale and open up massive security loopholes for bad guys to exploit at scale. An enterprise’s private and proprietary data is often true IP that, if engineered or reverse-engineered, outlines its competitive advantage and could compromise growth and profit.

So, in this new world, what will buyers of technology do? Where will they go for insight and calibration? They’ll lean heavily on trusted technology and strategic partners they’re in long-term relationships with—by choice or by contract. We believe enterprises will use those partners to bridge from experimental AI to strategic, foundational AI usage. We're a few years away from that happening, but we wove the assumption into the investment thesis for our second fund.

You all saw the data from MIT—only 5% of internal AI use cases are winning. We believe there are three reasons why; here are those reasons from a slide in our Fund II overview:

- Readiness — Systems, people and especially data are not equipped to realize the promise of AI. Data lives in lakes, marts, warehouses and databases, each speaking its own language and being used for a different purpose. AI needs structure to work. AI also requires that the people involved understand its strengths and limitations — from hallucinations to the systems’ inability to understand nuance.

- Clarity — What does success look like, clearly stated? Most companies can articulate strategic goals for AI projects—speed, efficiency, accuracy, workforce augmentation. What’s often missing is a concrete definition of 'enough'—enough accuracy to replace human review, enough efficiency to reduce headcount, enough augmentation to change outcomes, not just processes. Without that clarity, projects stall in pilots and never reach enterprise scale.

- Prime v. derivative perspective — SaaS startups got used to selling to buyers who came to them, not buyers with strategic outcomes in mind. Remember all the Schedule a Demo buttons over the past 20 years? The person on the other side of that screen was the derivative buyer, the person tasked with a set of specific features or capabilities to find and benchmark against existing systems or competitors. Well, the derivative perspective is irrelevant now. There’s no checklist for a product that may not even exist. The only perspective that matters is the strategic one.

Taken together, these three gaps explain why we believe the millions of AI products focused on the enterprise will fail: They can’t capture the customer.

The real battle in AI is for the customer

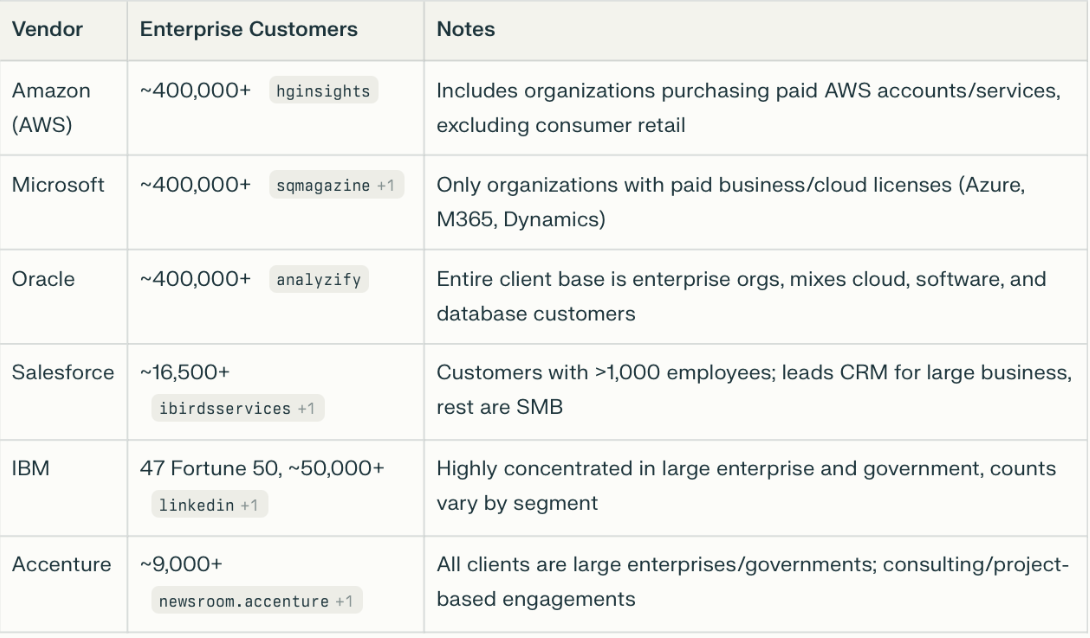

The power in AI will rest with the companies that have the deepest relationships with the most valuable customers. The 2023-24 data shows Oracle is well-positioned, with data as its core differentiator. So what does this mean? We believe the AI leaders—OpenAI and others—will scale through mutually beneficial technology and GTM partnerships with four giants: Oracle, Salesforce, Microsoft… and Accenture.

BTW, in Oracle’s announcement, CEO Safra Katz said this:

We have signed significant cloud contracts with the who's who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD and many others. At the end of Q1, remaining performance obligations, or RPO, now to $455 billion. This is up 359% from last year and up $317 billion from the end of Q4.

Our cloud RPO grew nearly 500% on top of 83% growth last year. [...]

I expect we will sign additional multibillion-dollar customers and that RPO will likely grow to exceed $0.5 trillion.

The enormity of this RPO growth enables us to make a large upward revision to the cloud infrastructure portion of our financial plan. We now expect Oracle Cloud Infrastructure will grow 77% to $18 billion this fiscal year and then increase to $32 billion, $73 billion, $114 billion and $144 billion over the following 4 years. Much of this revenue is already booked in our $455 billion RPO number, and we are off to a fantastic start this year.

OpenAI signed a contract with Oracle to purchase $300 billion in computing power over roughly five years.

When the team and I did our Exit Landscape report earlier this year, I was surprised at how many meaningful acquisitions Accenture has made. In the past two years, Accenture has made at least 40+ acquisitions (2023–2025), with notable activity continuing strongly into 2025. There are some consulting businesses, but also a lot of AI and forward-looking technology companies.

Now check this out:

- Accenture reported total revenue for fiscal 2025 of approximately $65 billion. The company mentioned that it had 30 clients with bookings exceeding $100 million in the first quarter of 2025, indicating significant concentration in large accounts.

- Assuming the top 100 clients contribute a substantial portion of total revenue, we can approximate an estimated revenue per top client. In consulting and professional services firms, top clients typically account for 50% to 60% of revenues.

- Let’s do the math. If, hypothetically, 60% of $65 billion revenue comes from the top 100 clients: Revenue from top 100 = $65 billion × 0.6 = $39 billion average revenue per top 100 clients = $39 billion ÷ 100 = $390 million. Per top 100 clients.

All told, Accenture’s top 100 clients likely generate, on average, roughly $390 million in revenue. Each. Annually. That’s tremendous. The power of Enterprise AI will be consolidated. We believe the real money, the lasting money, the projects that affect the revenue per customer, will be monopolized by Oracle, Microsoft, Accenture and a small handful of other players.

What does it all mean for you and us?

GWC’s Fund I is deep on enterprise productivity and AI. Our relationships with these players are essential to achieving scale and long-term profitability for our portfolio.

Our portfolio companies are already seeing the thesis play out: Multiple companies have secured partnerships with hyperscalers and the strategic advisors who monopolize enterprise customer relationships. These partnerships are accelerating their path to insights and scale, validating that the channel is becoming more powerful than the product in enterprise AI.

Precision capital: Our Fund II evolution

We've reverse-engineered what made Fund I strong, helping portfolio companies reach profitability in months, not years, and driving significant ARR growth in compressed timeframes. It’s not luck; it's a method. Fund II systematizes our approach through what we call 'Precision Capital,' which is woven into how we source, select and structure our involvement. We don't just invest; we architect the path to scale using the playbook we've already proven.

As we formally kick off the second fund, we're doubling down on this operator-led approach to the 4D Economy. The companies that win won't just have great technology; they'll have the enterprise relationships and channel partnerships to ride this wave of consolidation.

The heroes of the 4D Economy are creating the future of how enterprises will adopt and scale AI. And we're positioning our portfolio to be their essential partners in the transformation.

In our individual conversations, I look forward to sharing how we're working in lock-step with prime buyers at some of the most AI-forward enterprises to understand what truly matters to them. I’m not being figurative. We’re literally inside the rooms where these decisions are being made.

——

Important Note

This blog post is for informational purposes only and represents the views of Growth Warrior Capital as of the date sent. Nothing herein constitutes investment advice or a recommendation to buy or sell any security. The market observations and portfolio company updates shared are for illustrative purposes only. Please consult your professional advisors for investment decisions appropriate to your individual circumstances.